30+ iowa take home pay calculator

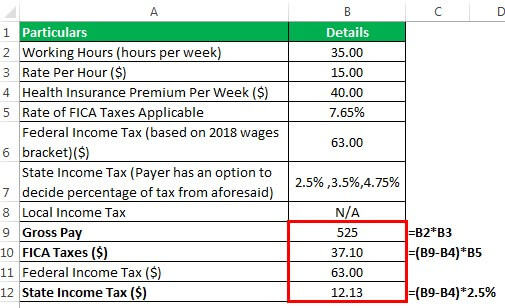

Web Iowa Hourly Paycheck and Payroll Calculator. Your average tax rate is 1167 and your marginal tax rate is 22.

Salary Calculator Employee Salary Calculator Tool

Web US Hourly Wage Tax Calculator 2023.

. Web This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate. Web The standard deduction dollar amount is 13850 for single households and 27700 for married couples filing jointly for the tax year 2023. Need help calculating paychecks.

Some calculators may use taxable income when calculating the. The Hourly Wage Tax Calculator uses tax information from the tax year 2023 to show you take-home pay. Figure out your filing status work out your adjusted gross.

See where that hard. Web Iowa uses tax rate tables to determine unemployment tax rates employers pay. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home.

Web Iowa Income Tax Calculator 2022-2023 If you make 70000 a year living in Iowa you will be taxed 11972. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Determine your filing status Step 2.

Use ADPs Iowa Paycheck Calculator to estimate net or take home pay. Net income Adjustments Adjusted gross income Step 3. Web How to calculate annual income.

Web Calculating your Iowa state income tax is similar to the steps we listed on our Federal paycheck calculator. Web This calculator estimates the average tax rate as the federal income tax liability divided by the total gross income. Web How do I figure out how much my paycheck will be.

Web Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Web Our Iowa Payroll Calculator Makes It Simple We want you to create the business of your dreams without having to deal with payroll taxes so weve designed a. Web Iowa paycheck calculator.

Taxpayers can choose either itemized. There are eight tables and for 2022 they are using table seven where rates are between 00 and. For example if an.

The Pros And Cons Of 529 Vs Utma Accounts Money

858 N Wood St 1811 W Iowa St Apartments 858 N Wood St Chicago Il Rentcafe

Understanding Sales Tax With Printify Printify

How Could I Calculate The Percentage Of The Annual Increase Of Customers On Excel Quora

Rgv New Homes Guide Issue 30 Vol 4 November December 2022 January 2023 By New Homes South Texas Issuu

Salary Calculator Employee Salary Calculator Tool

Severance What It Is How To Calculate It Levitt Sheikh Employment Labour Lawyers

N4216 State Highway 22 Shawano Wi 54166 Realtor Com

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

5700 Ingersoll Avenue Des Moines Ia 50312 Zerodown

Symmetry Software Offers Dual Scenario Calculators To Aid In Comparing Take Home Pay For Varying Deductions And Benefits

Plan 75470 Ranch Style House Plan

What Percent Of An Nba Salary Does The Player Take Home Quora

401k Calculator Retirement Savings Calculator

30 Mpg Vehicles For Sale In Ames Iowa Honda Of Ames

![]()

Qms Software Solutions For Sharepoint Bpa Solutions

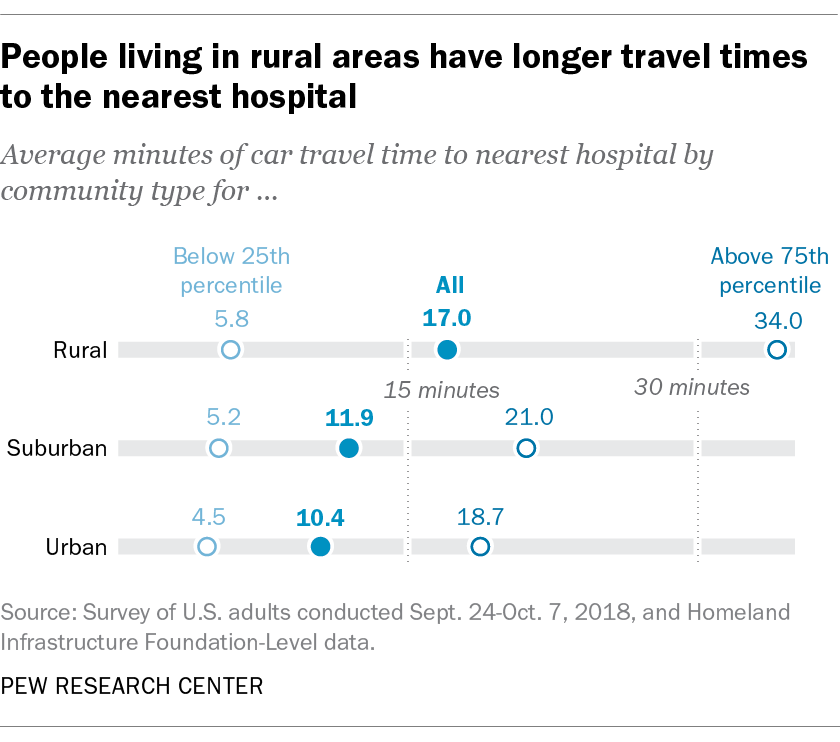

How Far Do Urban Suburban And Rural Americans Live From A Hospital Pew Research Center